ATTENTION:

If you’re credit starts with a 4, 5 or 6 and you have less than perfect credit …

$89.99 Down $89.99 A Month Credit Repair

Get the Credit Score

You need for approvals

Our team Is Ready To Dispute Your Credit Report with All Three Credit Bureaus

OUR EXCLUSIVE CREDIT TRANSFORMATION PROGRAM PROVIDES YOU WITH:

- Secrets to increase your credit score FASTER than you thought possible.

- Little known hacks to boost credit virtually overnight!

- How to qualify for HIGH LIMIT credit lines

- THE EXACT blueprint our clients use to eliminate ALL the negative remarks quickly and legally!

SO YOU CAN...

- Buy or Refinance Your Home

- Purchase a new vehicle

- Qualify for a Better Job

- Move into a Better Apartment

- Reduce Stress in Your Relationship

- Get Approved for Credit Cards (At low rates)

- Save Thousands of Dollars a Year

- Lower Insurance Payments

- Lower Car Payments

- The BEST Interest Rates

- Here's some stuff

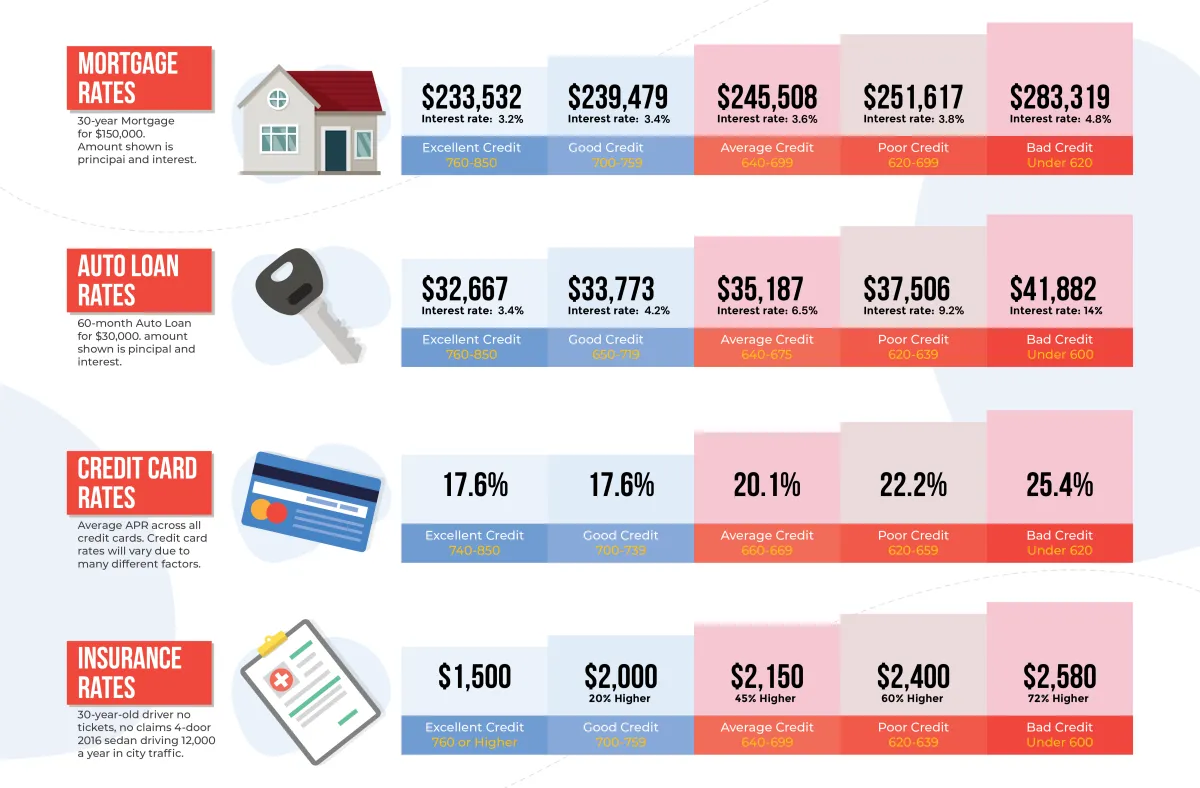

WHAT ARE THE TRUE COSTS OF POOR CREDIT?

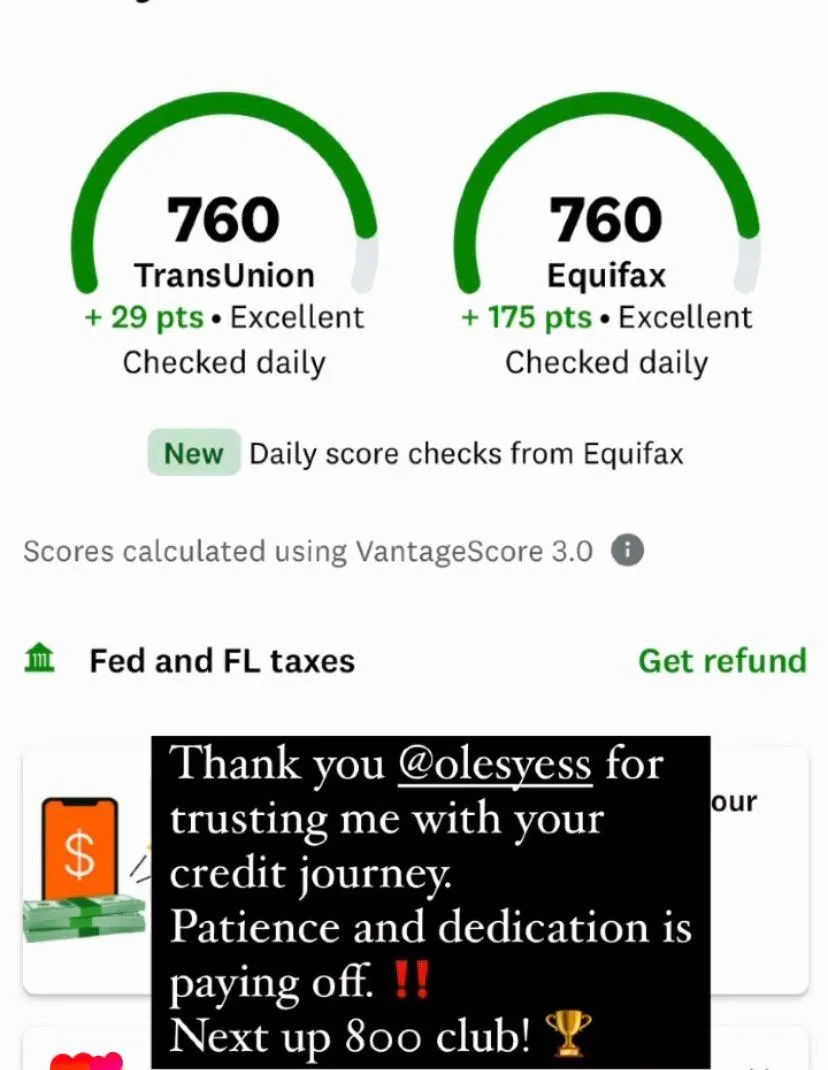

Your credit score could go up within 30 days

YOU'RE ONE STEP CLOSER TO CONQUERING POOR CREDIT ONCE AND FOR ALL.

THE PROCESS

STEP 1:

Click the button below to START your credit transformation program TODAY!

STEP 2:

Join the Family and instantly start improving your credit score!

*Spaces for the transformation program are extremely limited.*

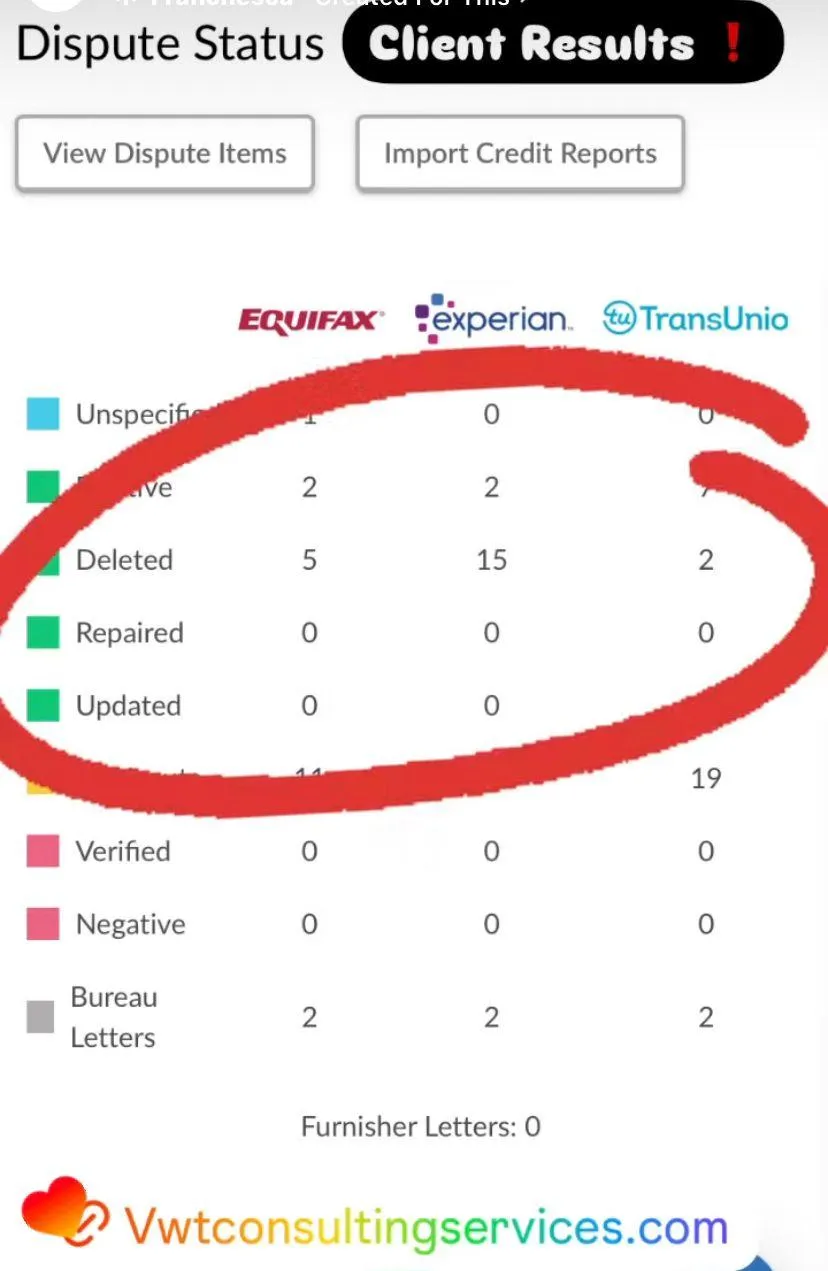

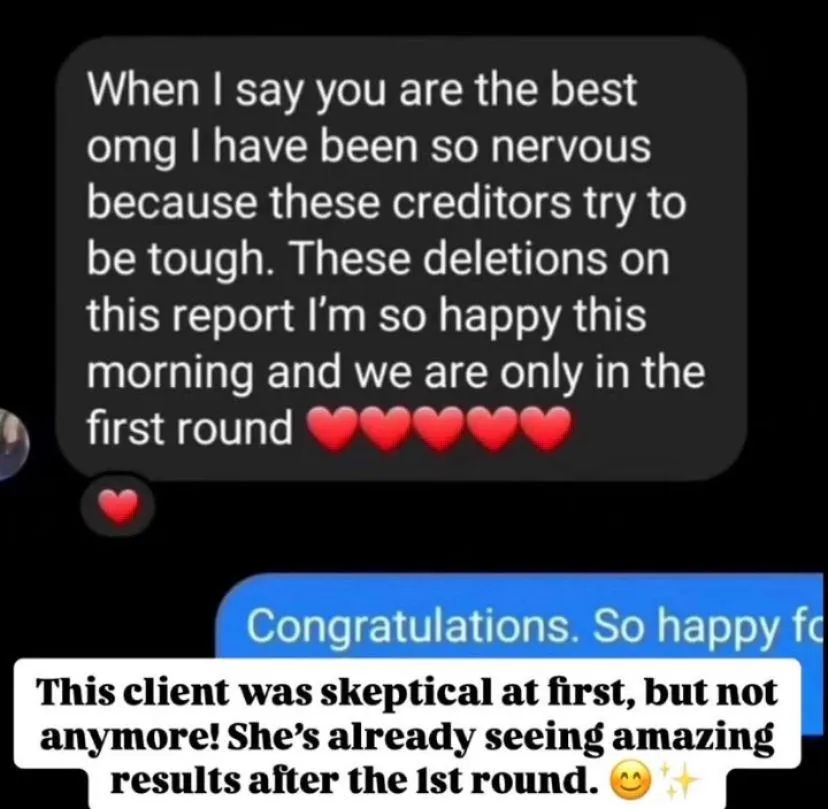

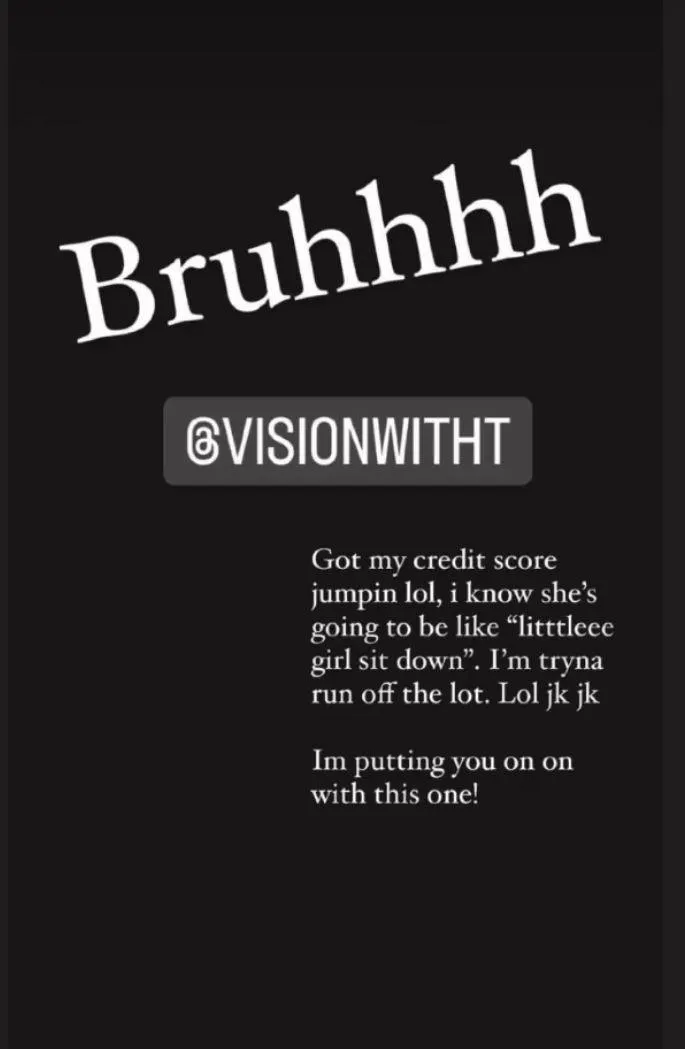

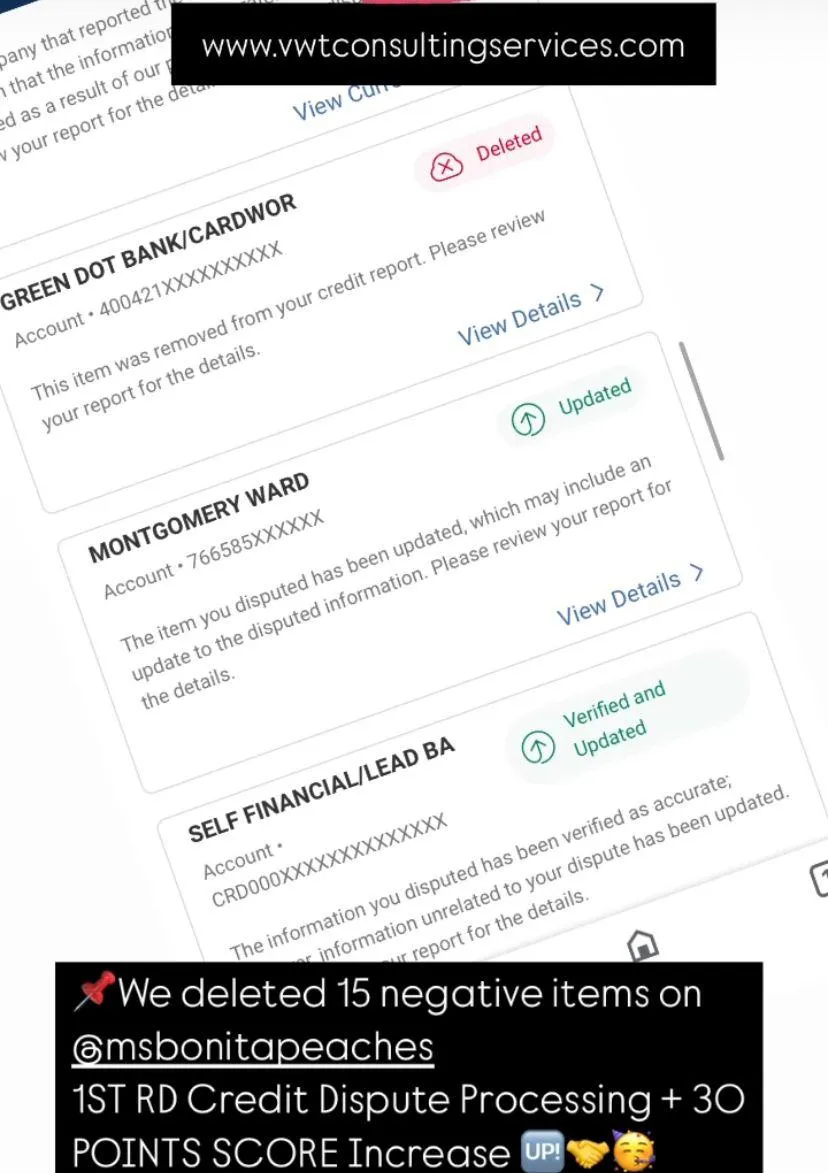

CHECK OUT SOME PROGRESS FROM A FEW OF OUR CUSTOMERS

CLICK THE BUTTON BELOW TO START YOUR CREDIT TRANSFORMATION PROGRAM TODAY!

WE KNOW EVERYTHING THAT YOU NEED

WE KNOW THE DIFFICULTY MAINTAINING A HEALTHY FINANCIAL LIFESTYLE THAT WORKS FOR YOU. WE LEARN TO UNDERSTAND YOU AND WHAT YOU NEED, AND HANDLE THE REST!

FREE AUDIT

We go over your credit report with you to find negative items that are inaccurate, help you understand the process of credit repair, and prepare a plan of action with you to improve your credit.

REPAIR

We dispute incorrect and unverified information on your behalf so that you can achieve the accurate credit scores you deserve.

SAVE MONEY

Lower your current interest rates on your loans and credit cards, and achieve access to better rates on new credit. You could save thousands every year!

WE IMPROVE YOUR CREDIT SO YOU CAN PURSUE YOUR DREAMS

SATISFACTION GUARANTEED, IF YOU DON'T SEE RESULTS IN 90 DAYS, WE OFFER 90 DAYS MONEY BACK GURANTEE

Spots are limited - APPLY NOW!

FREQUENTLY ASKED QUESTIONS:

Q: Why choose VWT Consulting Services to help you with Credit Repair vs other companies?

With our extensive background, experience, and expertise, we can help you with credit education, credit repair, & rebuilding your credit profile to increase your chances of achieving your dreams. The majority of consumers do not know their credit rights and what they can do to improve their credit and raise their scores. There are several federal laws that govern credit repair, credit reporting, credit scoring, debt collections, and more. With the help of our attorney and our vast experience, we are very knowledgeable of these particular laws to help you obtain better credit and raise your credit scores. The result of using our unique credit consulting and credit education system is that you will not only have better credit and higher credit scores; you will obtain the correct and factual information to help you for years to come. Other credit repair companies haphazardly delete accounts, ones in which they should have been corrected instead; drag the client out for approximately two years costing them way over a thousand dollars. More importantly, the majority of credit repair companies do not even know or understand the laws in order to answer clients’ questions or educate them. Knowledge and experience are extremely important in this line of work. You want to get the best results possible while not spend a lot of money to do so. This way they can obtain a new home, vehicle, new job/promotion, or just have pride in having better credit.

Q: Is Credit Repair legal?

Yes, it is totally legal in all 50 states. By utilizing the federal law, the Fair Credit Reporting Act (FCRA) under sections 611 (a)(1)(A) and (5)(A)(i), the law states that a consumer has the right to have an accurate credit report. If anything on a credit report that is inaccurate, obsolete, duplicate, misleading, or unverifiable, then you can correct or delete ANYTHING on your credit reports including bankruptcy, foreclosure, short sale, collections, charge-offs, late payments, tax liens, judgments, etc. By having these erroneous negative items deleted, your credit scores will improve. Keep in mind that deleting an account on a credit report does not mean you do not owe that debt.

The federal laws that we use and abide by are:

The Fair Credit Reporting Act

The Fair Debt Collection Practices Act

The Credit Repair Organizations Act

The Fair Credit Billing Act

The Fair and Accurate Transactions Act

The Fair Credit Equal Opportunity Act

Q: How fast can credit repair take to see results?

It all depends on how many negative inaccurate, obsolete, misleading, or duplicate items are on your three credit reports. It also depends on the credit bureaus properly doing their job by heeding the federal law, Fair Credit Reporting Act. Clients will usually see results from all 3 credit bureaus in as little as 35-45 days; faster if you are pulling a new credit report within 30 days. The credit bureaus may respond faster if they gather all of the information back from your creditors in a timely manner, which by law is no more than 30 days. Remember, credit repair is not a quick fix.

Q: Is there any guarantee with doing credit repair?

Although we cannot guarantee a certain outcome by federal law, we know that by utilizing the F.C.R.A., we can assist you in getting items corrected or deleted with an overall positive outcome in most cases. With our 28 years of experience, we know that we can improve almost every credit report that we see that have inaccurate information. Some of the work may include credit repair – disputing items that are inaccurate, obsolete, duplicate, misleading, or unverifiable on the credit report, paying down good accounts, negotiating debts to a lower amount, raising limits on credit cards, closing too many credit card accounts or establishing new/good accounts if the client does not have any credit or too little credit. We must follow all State and Federal Laws and will not deviate from them. If an item is not considered inaccurate, misleading, obsolete, duplicate, or unverifiable, then we will not dispute the item on your credit report. If necessary, a client can cancel our services at any time in writing.

Q: If I do not do credit repair, how long will negative information stay on my credit report?

The Credit Bureaus would like you to believe that all information stays for 7-10 years, regardless of anything you do. However, since credit repair is fully legal by the Fair Credit Reporting Act, the particular dispute process we use may DELETE these following accounts before this time frame. If you had the choice to wait it out for years or be pro-active and clean up your credit reports, which one would you choose?

Good credit - 10 years or longer

Negative credit (late payments, collections, charge-offs, closed accounts, child supports, civil and small claim judgments,

paid tax liens) - 7 years from the date paid

Chapter 7, 11, and 12 Bankruptcy - 10 years

Chapter 13 Bankruptcy - 7 years

Unpaid tax liens - up to 15 years

Inquiries - 2 years

VWT Consulting Services

Business Contact:

(866) 898-1177

Business Email:

[email protected]

Business Address:

10 Fairway Drive, Suite 100

#148 - V Deerfield Beach, Florida 33441

Customer Service Hours:

MON-FRI (11am - 5PM)

Copyright 2020 - VWT Consulting Services - All Rights Reserved

Privacy Policy

NOT TIKTOK OR INSTAGRAM: This site is not a part of the TikTok website, TikTok Inc., or the Instagram website, Instagram LLC. Additionally, this site is NOT endorsed by TikTok or Instagram in any way. TIKTOK is a trademark of TikTok Inc., and INSTAGRAM is a trademark of Instagram LLC.